Today, I'll be looking for value in SEACOR Marine Holdings (NYSE: SMHI) and Genco Shipping Limited (NYSE: GNK).

Their 10 yr bonds (the day their full principal has to be repaid) is due on 15th May 2030,

Business Model

For SEACOR, their revenue is derived mainly from supplying fast support to crews working on oil drilling operations across the Atlantic Sea. For Genco, their revenue ... In contrast to Genco Shipping, SEACOR's revenue is exposed heavily to oil drilling operations, and as a result, its stock price is exposed to shocks in oil price volatility. This can be seen in their Fast Support Vehicles (FSV), where utilization rates dropped from 67% to 52%

During this quarter (Q1 2021) their cash position improved significantly, standing at 68 million compared to last quarter of 32 million. This is primarily due to the sale of their business Windcat Workboat Holdings Ltd, which brought in an additional 22.8 million. Despite that, they seem to drop 10 billion in net cash every quarter.

A

Approaches to valuing negative earning companies

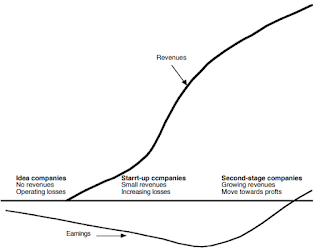

So how exactly do you value companies that have negative cashflows or earnings? Many of the commonly relied on metrics such as PE ratios or EPS can't be relied on. While the approach to valuing negative earning companies are more difficult, there is still inherent value in young growth companies, hence it is important to use the right approaches. Here is a typical outlook on prospective young growth companies.

In the early stages, companies are faced with heavy startup costs usually associated with building up a company. Initially, these costs will eat into their revenues giving them negative cash flows, but as time progress, these companies enjoy the benefits of economics of scale of generated revenue streams, while depreciating their original invested capital.Depressing Outlook

Since their earnings are negative, we can't really rely on the income statements or any shortcuts such as Operating Margins, to help give us a clear picture of its intrinsic value in the future. So, we must look into the cash flows of this firm. From the past 4 quarters, we can see that they burn through roughly 10 million per quarter. In terms of survivability, I predict based off of their current situation that they can operate for 5 more quarters worry free. I say 'worry free' with air quotes, what I REALLY mean is that their company is failing. Why the hell are they still issuing such high compensation to their board of directors? We can tell by September 30, 2020 that the firm had issued 755 thousand shares to their directors. And on average, each director doesn't hold their shares for very long (source: pending investigation). To make matters worse, they aren't making any reinvestments to their firm. Compared to Genco Shipping, SEACOR is actually offloading their Windcat vessels and business. Sure, that cuts down on operating costs substantially, but its not like any other parts of their business was running efficiently anyways. Sure, direct vessel profits had an operating margin of 12% for the year 2020 (1.3/11.2 Million), but they kept losing money from their property, compounded with the problem of depreciating usefulness. (note Property Depreciation for Q120 - Q121)

Examining their fund raising methods

When looking for growth value in a stock, you must take care that the data you sourced are of quality and free of any errors. So before I turn to compute Earnings Per Share (EPS) or turn to look at the company's Earnings Before Interest, Taxes (EBIT), I examine whether the companies are running efficiently are ask myself whether these companies can cut down on these problems to stimulate higher growth.

Reinvestment: Genco's procurement of new vessels

Often, a good intuitive indicator of the insider management view on the 'longevity' of their company is by looking in reinvestment rates. In our scenario, the reinvestment can be found in business acquisitions of adding new ships to their fleets. Similar to R&D in a tech company, where money is pumped back into companies for to generate new tech and acquire patents for products. Vessel acquisitions, is where money is spent for these companies to acquire new ships in order to continue operating business and cut down on operating costs (think fuel and oil). Simply put, capital expenditures (CapEx) is as critical to Maritime Transportation Companies as R&D is as critical to Tech firms.

Announcement of Upcoming Dividends

One thing we take into consideration when calculating intrinsic value is dividends. Following the latest quarterly report, Genco Shipping Limited has announced that they would issue dividends.

The dividends for the next quarter can be anticipated to be 0.05 per share. (Source: Guidance Report) We should take this factor into consideration when calculating our intrinsic value as it is an expense on our cash flows.

Analysis of Trends

We should begin by building a picture of what their earnings and expenditures look like, here is data from 2016 to 2020, detailing their trends of Revenue, SG&A, COGS, and Net Income.

Here, we can observe that net income improved substaintially compared to previous years. Although averages are not good indicators of future efficency, they can give us a rough estimate of what expenditures to expect for the next couple months.

The Forecast Begins

Now with the formalities out of the way, we can begin to forecast their growth (if any) for the next couple of years. Firstly, for the second quarter of 2021, I believe they will incur a total COGS of 76,109. I forecast for the year 2021, items 6-10 will inccur a 10% reduction, with an overall COGS reduction of 8% YoY. However, their General & Administrative and Managment fees, items 9 and 10 respectively, will grow in line with Revenue of 1 percent.

The assumptions will be listed below:

(Lease R +1%, Spot R +2%, Total SG&A -10%, Total COGS -7%)

These previous stated assumptions will carry across the second and third quarters. Moving onto the year 2022, I maintain that their firm will struggle to gain footing for a while with Revenue at 355,560 and total Operating Expense at 456,630. This continues until 2026 (or Phase 1, if you would), where the firm becomes profitable (meaning their net income is non negative for the first time). Here, the firm's revenue continues to grow at 1 percent, while facing decreasings overall costs. Before, the firm was losing money and was not taxed, here we will assume they begin take a tax rate of 18%, the industry average. Moving onto the year 2030 (Phase 1.5), their SG&A and COGS stops decreasing and starts increasing at 1% in line with the revenue growth. In year 2022 (Phase 2) the firm reaches peak growth, and in the following year (Phase 3) the firm reaches stable conditions. With estimate their revenue will grow at a rate of 0.5%, with their SG&A and COGS growing at 1 percent and taxes at 10%. These forecast variable will continue to be used in perpetuity.

Discount Rate

The most crucial part of the forecast model involves the discount rate. Discount rate is the interest rate you require for stock investments in order to account for its riskiness inherent in the concept of the time value of money. Since their financing of the 2 new vessels includes both debt and equity, I will be using Weighted Average Cost of Capital (WACC). To find the discount rate, you must find cost of equity, the cost of debt, and their relative proportions to their sums. The WACC is found to be 5.36%.

Using the WACC (5.36%) as the discount rate, we arrive at the net present value of 915 million, deducting their current net cash of 269 million we get a terminal value of 646 million, or 15.42 dollars per share.

We see that the value we have arrived at is not far from their current value, and altough their growth is promising, I wouldn't buy into neither Genco at such a high price.

Concluding Thoughts

It would take 'half a miracle' to wrestle this company's profitability out of its current spiral. Genco Shipping on the other hand is a much better choice for long term prospects. This can be argued on three basis: (1) its operating efficiency, (2) its reinvestment rate, (3) its upcoming dividends. However, I sense heavy insider trading activity against this stock so I wouldn't bet against it. Secondly, I would not purchase Genco Shipping's company right now. As of 05-June-2021, their stock stands at 15.74. Our valuation model provides use with 17.26. I do not deem that there is a sufficent margin of safety.

The model is free to download, and provides only raw data. For futher information & enquiries please call +852 9181-8099 or email me at dompatrick2021@gmail.com. Download Model