Some Intros

So before you begin to find some objects why are we trying to look at the intrinsic value of this company. The purposes are twofold: Firstly, I want to try to do a little bit of preparation for CFA examination and the topics that have always interested me are in-depth financial analysis and the techniques to use to do comparable valuation, so I thought I’d start there first. Secondly, I have some spare time on my hands and I thought perhaps looking at the current state of Microsoft could perhaps give me a larger viewpoint of the overall health of the financial market such as the S&P 500 index and taking a close in work as specific firm before zooming out to look at the larger overall state of things in terms of stock investing. I know before I’ve said before that I was prepared to value Nvidia NVIDIA Corporation (NASDAQ: NVDA) the last blog, but I think the majority of their price increases half can largely be attributed to their 40 billion takeover of Arm, and to be frank, I haven’t spent much time doing M&A Valuations before. So, instead I’ll be valuing sticking to a more traditional tech company like Microsoft where a lot of people will also be analyzing it when you so in the least we’ll benefit from this as a learning process by knowing whether we are that far off the mark in terms of finding an ‘accurate’ intrinsic value.

Starting with the Stock Price

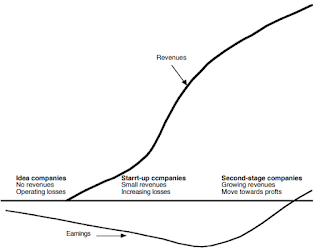

Some interesting things to know about Microsoft stock performance is that — starting from 2016 — within 1 year of holding onto gives you roughly 63% returns, for 3 years 223%, and for 5 years 450%. While on the revenue side for the year-over-year 2020 to 2021 Microsoft has a revenue increase of 17.5%, for 3 years it's 52.2%, for 5 years it’s 84.2%. I think this gives you very interesting insight into investor expectation of revenue increases relative to the stock price performance in the long-term future. Just from this small string of data you can make out (and to an extent reverse engineer) the general public expectation of the stock prices performance in the long-term future. Further, You can observe an interesting relationship between the stock price of the common stock and the magnitude of how it’s annual revenue growth affects the also “second-order” growth in the growth of the company’s stock price aswell.

Math:

1.00*(1+0.059)*(1+0.143)*(1+0.14)*(1+0.136)*(1+0.175) = 1.842

1.00*(1+0.14)*(1+0.136)*(1+0.175) = 1.522

1.00*(1+0.175) = 1.175

Breaking down their Revenue into Segments

In order to provide for more accurate values for the specific components of Microsoft’s business, instead of restoring to common “price/earnings” ratios that give you no useful information whatsoever about the competitiveness of their product line. Let’s break down their Revenue by specific segments. So primarily, on their relations they break down their revenue by 3 segments: Productivity and business processes, intelligent cloud, and more personal computing. However I think we could go a little bit more specific into that. We know Microsoft is famous for their operating systems windows, that's why we can assume the majority of their revenue comes from. Then we have consumer Communications platforms like Microsoft teams, where the major competition comes from Discord, Zoom Communications, Facebook Messenger, etc. A lesser known product is Dynamic 365, which operates in a business to business environment providing data analytics for companies. Last but not least gaming which has the new Halo as came out. I personally have bought the new Halo infinite which is very fun to play on but they're Xbox system sales seems to stagnate compared to other competition like PlayStation Nintendo switch even.

Growth of Costs versus Revenue

Let’s compare their long term “growth rate of operating income with growth rate of operating cost” This is the data I’ve compiled showing the growth rate of their operating income vs operating cost. Interestingly, from 2020 to 2021 Microsoft increased their PP&E and Operating right-of-use lease by 35% and 26% respectively. Does this mean their are perhaps expanding in some sectors? Probaly. In which one? Super computers? Data centers? Giga factories? One can only guess... Before I know more, I will intuitively guess that this is a substain increase specifically both horizontally (comparable in it's own year in the asset category) and vertically (comparable to it's previous historic years). And... I was correct. This is really intriguing then, saving this for later.

EBIT

So EBIT (Earnings before Interest Taxes) can be simplified as Operating Income. For the year 2021, EBIT is 69,916 adding back depreciation & amortization 10,900. We won't be using EBIT as a driver in this model, but rather but summing up all the Net Income of the subsquent years and using Excel's built in net present value formula of =npv().

Our Assumptions

The following numbers are the crucial numbers for our valuation. The numbers next to the blue marked text indicate it is a future forecast value, while anything prior to it is historical.

Conclusion

Briefly looking at Quant Metrics, here's what I got. Keep in mind there are baseless predictions, and simply premises a reversion to the mean.

Conclusion

The entire market is overvalued right now, Microsoft moreover is leading this "overvaluation". If you want to buy stocks, fine, just find something more fairly valued. I have done this DCF valuation from the ground up, there is no bull or bear case that will justify this lack of a margin of safety. If you buy Microsoft and hold it, don't expect astronomical gains.